wells fargo class action lawsuit payout

The Wells Fargo lawsuit 2018 settlement was announced in December. Those with a Wells Fargo loan may be able to benefit from the settlement if between 2010 and.

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement

When you were considered for a loan modification you werent approved and now we realize that you should have been.

. The bank is paying out 185 million to resolve the lawsuit. The 21-page lawsuit claims that even though the plaintiff was wrongfully debited 7500 through a Zelle scam Wells Fargo has not reversed or refunded the money despite being obligated to do so. The Wells Fargo lawsuit resolves claims of fraudulent activities involving unauthorized accounts forged signatures and unauthorized services.

As a result the bank was ordered to pay out more than 200 million to victims of. A settlement deal with the Financial Industry Regulatory Authority has settled class action claims made by Wells Fargo. 11 In addition to a.

The company has since revised its public descriptions of its sales practices. The securities filing says that Wells Fargo discovered a calculation error in its automated software for calculating whether a borrower should be offered more favorable loan terms in lieu of foreclosure. Wells Fargo says the error affected 625 homes that were in the foreclosure process between April 13 2010 and October 20 2015.

The company has since apologized and resolved the cases. For all businesses that received a phone call from a call center operated by International Payment Services LLC or one of its affiliates between March 7 2011 and May 7 2014 then you are eligible for a potential award from the Wells Fargo Settlement Call Recording Claims Class Action Lawsuit. Although the settlement does not completely.

The process is expected to take until early 2020 as there are hundreds of thousands of eligible class members to compensate. Wells Fargo CPI Class Action Settlement. According to the lawsuit plaintiff alleged International Payment.

By Pete Williams. Wells Fargo Alter Egos Sold Predatory Home Loans Engineered to Foreclose Claims Borrowers Lawsuit. This settlement resolves a lawsuit against Wells Fargo Bank NA Wells Fargo Co National General Holdings Corp.

The company has agreed to pay 3 billion to resolve the claims. This settlement is a win-win for both sides. The settlement in the Wells Fargo unwanted auto insurance lawsuit has been preliminarily approved by the Court and the settlement checks are being mailed out to eligible customers.

The suit was filed in May 2015. The lawsuit also claims that Wells Fargo falsely altered the mortgages of consumers who had filed for bankruptcy. In the end Wells Fargo agreed to pay 142 million to the affected parties.

In re Wells Fargo Collateral Protection Insurance Litigation Case No. We based our decision on a faulty calculation and were sorry. The investors were misled by the banks cross-sell strategy which involved opening millions.

The suit is a result of an investigation by the Securities and Exchange Commission into the father-son investment firm EquityBuild. In the end the company was forced to reimburse overdraft victims 203 million in refunds. The banks overdraft policy was found to be unconstitutional under federal law.

Plaintiffs Reply In Support of Motions for Final Approval of Class Action Settlement and Attorneys Fees and Brief of Amicus Curiae PDF Court Orders. According to the complaint the banks executives violated consumer rights by making misleading statements and failing to disclose material facts to increase sales. March 26 2021 458 pm By James Kleimann.

1 The class-action lawsuit targets a wide array of Wells Fargo policies from the controversial points-of-sale system where homeowners were charged interest on their account balances for balance transfers. To the now-banking giants robot program which the plaintiffs say does nothing but waste money on non-performing loans. According to the lawsuit Wells Fargo reportedly sent out checks to borrowers who were wrongfully denied loan modifications along with letters that stated.

Those employees many of whom were unionized suffered the. Feb 23 Reuters - Wells Fargo Co was hit with a proposed class action lawsuit on Wednesday accusing the bank of routinely requiring hourly employees in Florida to work overtime without pay. Wells Fargo the nations fourth-largest bank agreed Friday to pay a 3 billion fine to settle a civil lawsuit and resolve a.

The Wells Fargo overdraft lawsuit payout 2016 was the result of a long court battle. And National General Insurance Company collectively Defendants alleging that between October 15 2005 and September 30 2016 Defendants unlawfully placed collateral protection insurance CPI policies on Class. The lawsuit alleges that Wells Fargo failed to provide customers with a partial refund of the fees paid for Guaranteed.

Read on to learn more about the settlement. The plaintiffs in a recent class-action lawsuit against Wells Fargo are seeking full compensation for victims of the mortgage lenders deceptive practices. A Wells Fargo class action lawsuit was filed in June 2016 in response to the banks actions in the financial industry.

This includes misleading marketing and poor customer service. However a settlement is not necessarily a guarantee of a recovery. Wells Fargo agreed to pay 957 million to more than 5300 home mortgage consultants to resolve a pair of class-action legal claims that allege wage-and.

Wells Fargo Bank NA Case No. As the settlement demonstrates a class action lawsuit payout may not be as large as you may have expected. The settlement includes 500 million in investors money.

The bank will pay 365 million to the plaintiffs as well as their legal expenses. The lawsuit against Wells Fargo cites multiple instances of the banks failure to disclose material information to consumers. Ultimately Wells Fargo denied the class action lawsuits allegations but agreed to pay 185 million to settle the dispute.

The bank has agreed to pay 185 million to resolve the allegations. Wells Fargo home loan customers who lost their homes may be able to benefit from an 185 million settlement that if approved by the court will end a class action lawsuit alleging bank errors led to mortgage holders losing their homes to foreclosure. The Settlement resolves a class action lawsuit against Wells Fargo in the United States District Court for the Central District of California Armando Herrera et.

Wells Fargo and a group of affiliated mortgage lenders use deceptive tactics to push customers into a complicated risky and expensive loan so they can sell as many loans as possible to third party investors while the.

Wells Fargo Agrees To 28m Settlement Over Call Recordings Top Class Actions

Wells Fargo Bankruptcy Credit Reporting 3m Class Action Settlement Top Class Actions

Wells Fargo Fake Account Lawsuit Settles For 110 Million Fortune

28m Wells Fargo Settlement Resolves Call Recording Claims Top Class Actions

Wells Fargo To Pay 3 Billion In Settlement For Fake Accounts Scandal Nbc Nightly News Youtube

Wells Fargo Wins Dismissal Of Shareholder Lawsuit Over Commercial Lending Reuters

Wells Fargo To Pay 185m For Aggressive Illegal Sales Tactics Wells Fargo The Guardian

Wells Fargo To Pay 32 5 Million To Settle Lawsuit Over Its 401 K Plan In 2022 Wells Fargo In Law Suite Fargo

Wells Fargo Wins Dismissal Of Shareholder Lawsuit Over Commercial Lending Reuters

Wells Fargo Lawsuit Cites National General Insurance New York Business Journal

Wells Fargo Reaches 3 Billion Settlement Over Fake Accounts Scandal The Washington Post

Wells Fargo Pays 72 6m Settlement For Overcharging Foreign Exchange Customers San Francisco Business Times

Wells Fargo Class Action Lawsuit And Latest News Top Class Actions

Wells Fargo Forced To Pay 3 Billion For The Bank S Fake Account Scandal

Wells Fargo To Pay 575m Settlement For Setting Up Fake Banking Accounts Us News The Guardian

Troy Harlow Has Always Made Sure To Pay His Mortgage On Time Wells Fargo Had Other Plans For Him

A Black Homeowner Is Suing Wells Fargo Claiming Discrimination The New York Times

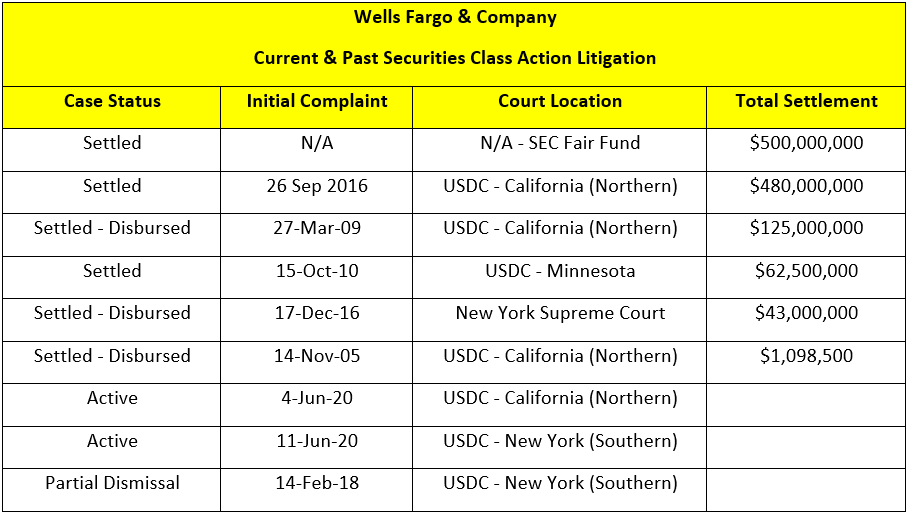

Investors Closer To 500 Million Payout From Wells Fargo Settlement